The Bangko Sentral ng Pilipinas (BSP) is aggressively promoting digital transactions via the national QR Code and government online payment facility as part of “New Economy” arrangements.

BSP Assistant Governor Illuminada T. Sicat said by the end of 2020, financial institutions that use QRPh will increase to 20 from the existing eight.

Sicat said they have been pushing for the bigger adoption of the QRPh and in the case of EGov Pay, to increase participation for a safer and more efficient government collections and disbursements.

“The rise in EGov Pay transactions reflects the deepening public awareness of these digital facilities as a safe and efficient means of payments for taxes, licenses, permits and other obligations to the government,” said Sicat during the virtual 18th Development Policy Research Month Kickoff Forum of the Philippine Institute for Development Studies (PIDS).

Since the BSP launched EGov Pay in November last year up to end-June 2020, transactions by volume increased by 688 percent while in terms of value, it went up by 799 percent.

Sicat said from just two participants last year, the number increased to 277 by end-June this year,

exceeding their target of 180 by end-2020. The Bureau of Internal Revenue is top biller using EGov Pay, followed by Philippine National Police, the Environmental Management Bureau and the Overseas Workers Welfare Administration.

“The QRPh (is also) showing promising trends,” said Sicat. In the same period as of end-June, transactions in volume increased by 1,214 percent since its launching in November 2019, while value was up 1,374 percent.

“Given the bullish expectations on the P2P (person-to-person) QRPh, there are 12 more BSFIs (BSP supervised financial institutions) that are set to launch this payment facility within the year. This is on top of the existing eight financial institutions already currently enrolled,” said Sicat.

QRPh only facilitates payments for now.

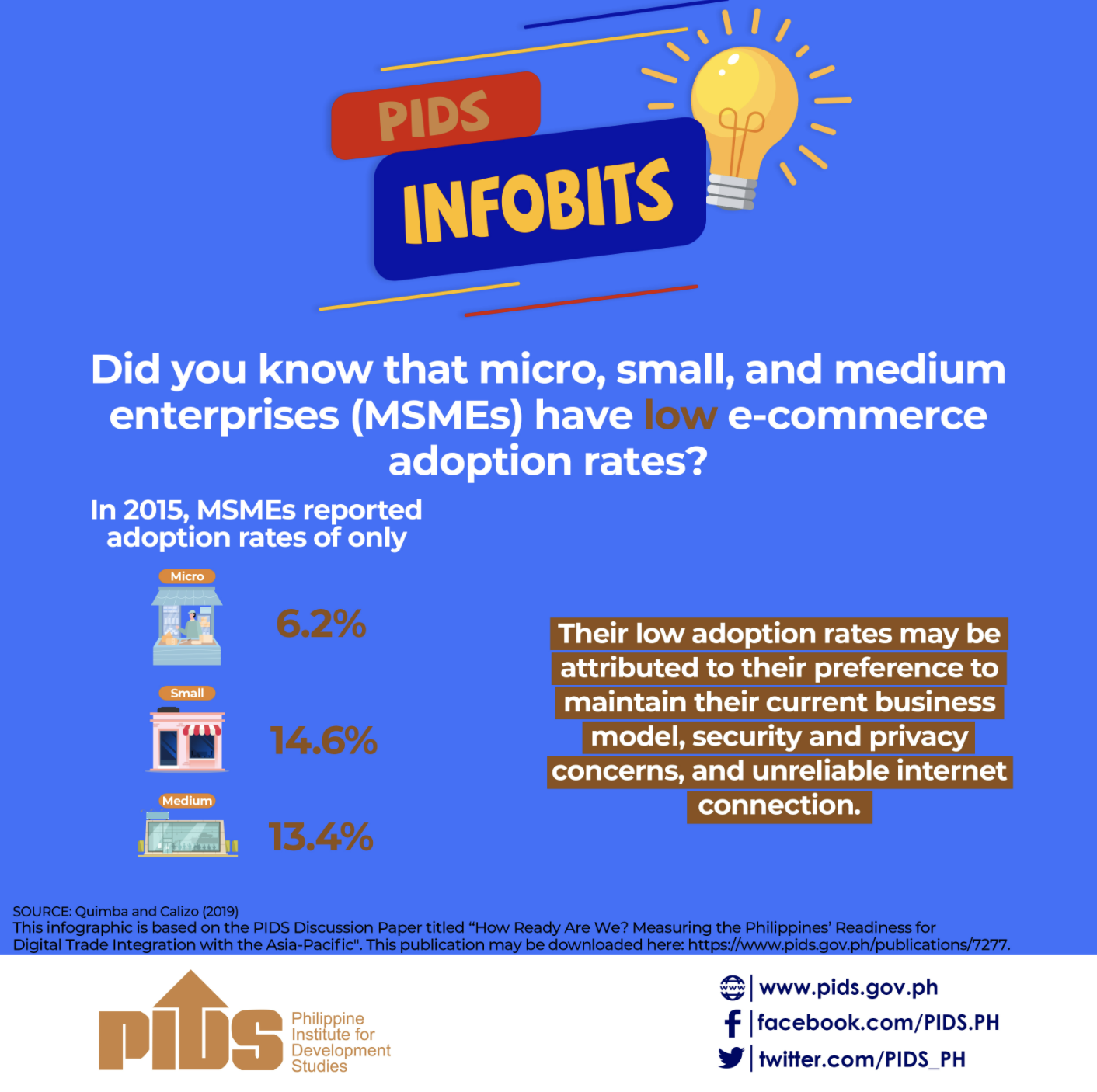

BSP Governor Benjamin E. Diokno said earlier this year that the P2M QRPh is targeted to be launched in the fourth quarter and will cover all merchants including micro, small and medium enterprises.

This will enable merchants, including micro and small vendors, to accept e-payments by merely displaying a standard QR Code for their customers to scan, according to Diokno.

EGov Pay uses the digital payment channels of PESONet while the QRPh uses InstaPay.

Sicat said BSP is actively promoting the use of PESONet as a “viable alternative to checks and recurring bulk payments while InstaPay as a substitute for cash.”

The BSP has noted a decline in check and cash transactions during the enhanced community quarantine period, even during the more relaxed lockdown measures. The volume of ATM transactions has also decreased during the lockdown.

As of end-July, PESONet has 60 participating financial institutions and InstaPay has 47. The latest data show that PESONet transactions have reached 2.6 million in terms of volume, up 137 percent year-on-year. InstaPay transactions volume-wise have increased 739 percent year-on-year. Majority of banks have waived the transaction fees of PESONet and InstaPay until end-September, and some until end-2020.

“The BSP is setting the stage for the rise of the ‘New Economy’, centered on the use of electronic payments and settlements,” said Sicat, adding that the central bank “remains committed in implementing necessary policy measures and reforms to help the Philippine economy recover from the COVID-19 crisis and to build its resilience against future crises.”

The New Economy of digital payments is expanding faster than anticipated because of the COVID-19 lockdowns and will likely reach 50 percent of all payments transactions before mid-2023, which was the BSP’s target.