FINANCIAL institutions need to consider serving more female-owned micro-, small- and medium-sized enterprises (MSMEs), which are disadvantaged in accessing capital relative to male-owned businesses, the Bangko Sentral ng Pilipinas (BSP) said.

In a webinar hosted by the Philippine Institute for Development Studies on Thursday, BSP Deputy Director Mynard Bryan R. Mojica of the Financial Inclusion Office said 58% of women-owned MSMEs cited lack of access to funding as an issue in doing business, against 37% of male-owned MSMEs.

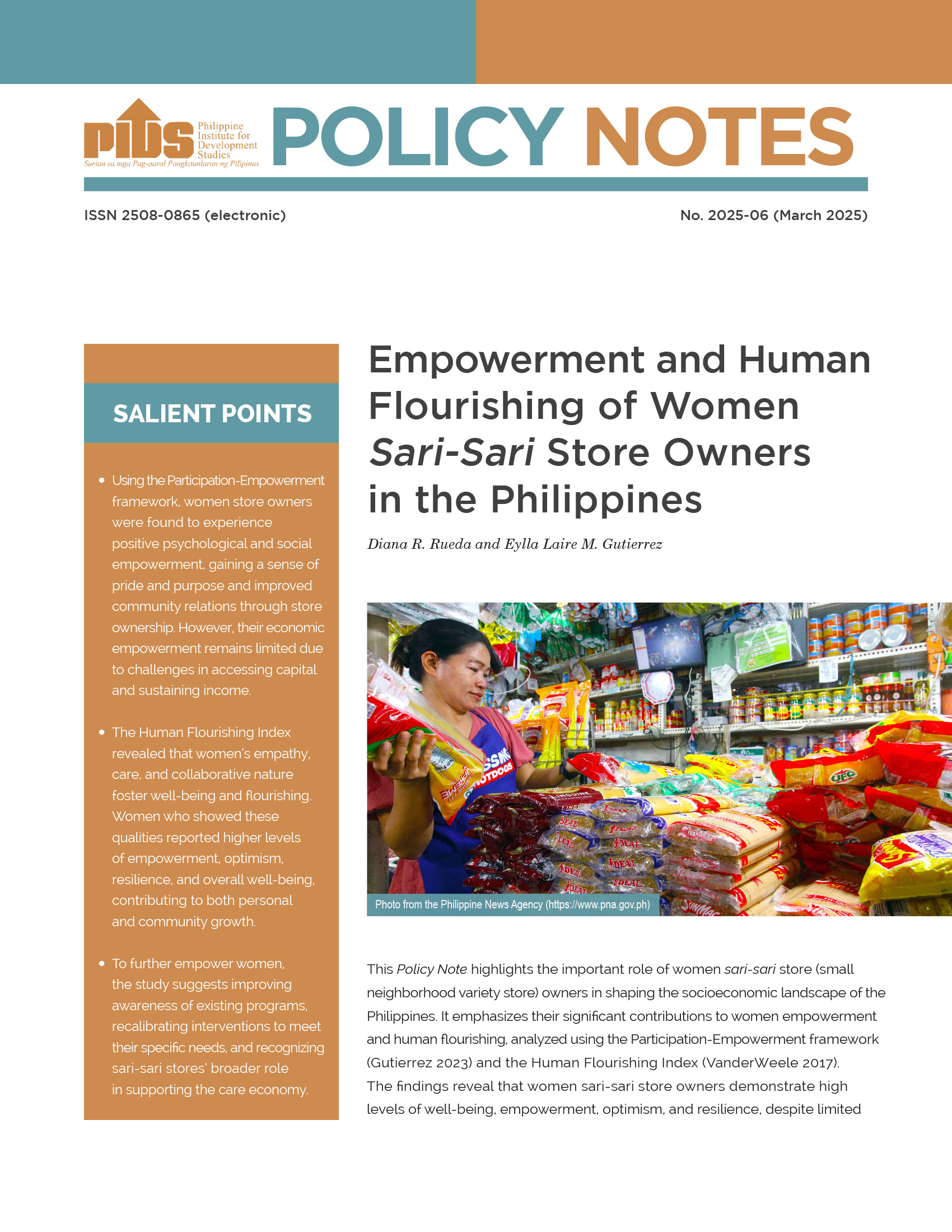

“Many of the micro enterprises are women-owned. An overwhelming 45% of them are women-owned. Many of these MSMEs are newly created and built from scratch,” Mr. Mojica said.

“We need to take advantage of the largely untapped women-owned MSME market by tailor-fitting financial products and services to their needs and preferences,” he said.

In his presentation, Mr. Mojica cited the results of a survey by the Asian Development Bank, which the Philippine central bank collaborated in.

The survey, which consulted 1,000 MSMEs, found that 45% of micro businesses were female-led, against 15% led by males. Most of the female-owned MSMEs are active in the wholesale and retail trade, accommodation and food services, and manufacturing.

According to Mr. Mojica, both men (78%) and women (64%) use their own funds to build up capital for their small businesses.

Of the businesses tapping outside financing, 6% of female-led MSMEs borrowed from microfinance institutions while 5% tapped informal lenders.

“For bank accounts, we find that (banks are) more biased towards men. But microfinance companies and cooperatives… are serving more women,” he said.

Aside from lack of capital, respondents cited high taxes and high cost of doing business as significant barriers to growth.

The survey also found that female-owned MSMEs used fewer financial services than male-owned ones, with female-owned businesses also less likely to use digital financial services, for which the usage rate for male-owned businesses was over 40%.

Some 52% of female entrepreneurs 27% of male business owners still use mainly cash in financial transactions.