THE national government's debt servicing was higher in May 2022 compared to payments made a year earlier because of higher interest payments and amortization charges, according to data released by the Bureau of the Treasury.

Debt payments were P57.44 billion in May of this year, up 51.96 percent from P37.80 billion in May 2021.

Interest payments increased 16.92 percent to P3.81 billion, or 58.89 percent of the total servicing.

From P24.11 billion a year ago to P28.87 billion in May 2022, domestic interest payments climbed by 19.74 percent, while external interest payments saw an uptick of 2.86 percent, to P4.96 billion from P4.82 billion.

Amortization costs soared from P8.86 billion to P23.61 billion, or 166.30 percent, year on year.

Since there were no domestic payments made in May, the sum only includes the external amortization. In May 2021, external amortization was P8.07 billion.

Debt servicing was P414.06 billion in the first five months of this year, including P172.35 billion in interest payments and P193.60 billion in amortization.

In 2021, the government paid P1.20 trillion in debt repayments to creditors, up 35.1 percent from P926.46 billion in 2020. The national government has established a P1.29-trillion debt repayment budget for this year.

The national government's outstanding debt dropped to P12.50 trillion at the end of May, according to the Treasury.

The majority of the obligation was borrowed locally (69.3 percent), with the remaining originating from elsewhere.

Local debt was down by 3 percent, to P8.66 trillion from P8.93 trillion, at the end of April. External debt widened by 0.1 percent, to P3.83 trillion from P3.82 trillion.

Finance Secretary Benjamin Diokno has said the new administration targets to normalize the debt-to-gross domestic product (GDP) ratio of the government from this year's level of 61.8 percent to 61.3 percent by 2023; to 60.6 percent by 2024; 59.3 percent by 2025; 55.7 percent by 2026; and 52.5 percent by 2027.

"In other words, by the end of the Marcos years, we expect the national debt-to-GDP ratio to be below 60 percent, which is the hold threshold," he explained.

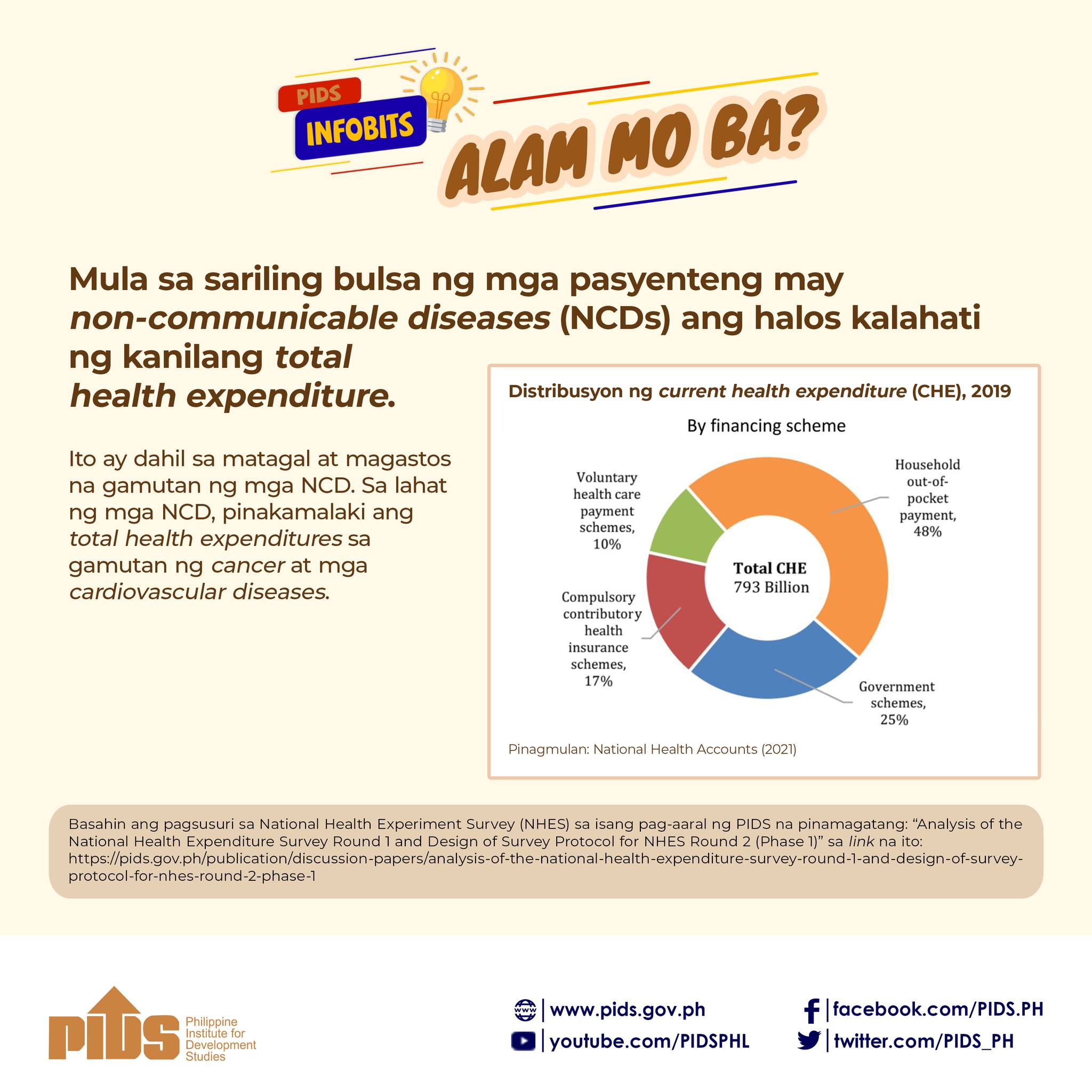

State think tank Philippine Institute for Development Studies (PIDS) has said the country's most recent debt spike appears to be less concerning than previous debt episodes.

The authors of the report published by PIDS, in collaboration with the Bangko Sentral ng Pilipinas, noted that the immediate effect of the Covid-19 pandemic on fiscal performance was a collapse of revenues due to a shrinking economy, an inevitable widening of the fiscal deficit as the revenue drop coincided with increased spending and eventually a sharp accumulation of public debt.

They underlined that the national government debt-to-GDP ratio increased from 39.6 percent in 2019 to 54.5 percent in 2020, and is presently at 60.5 percent in 2021.