Small and medium-sized enterprises (SMEs) are the backbone of the Philippine economy, accounting for a substantial portion of the country’s employment and economic output.

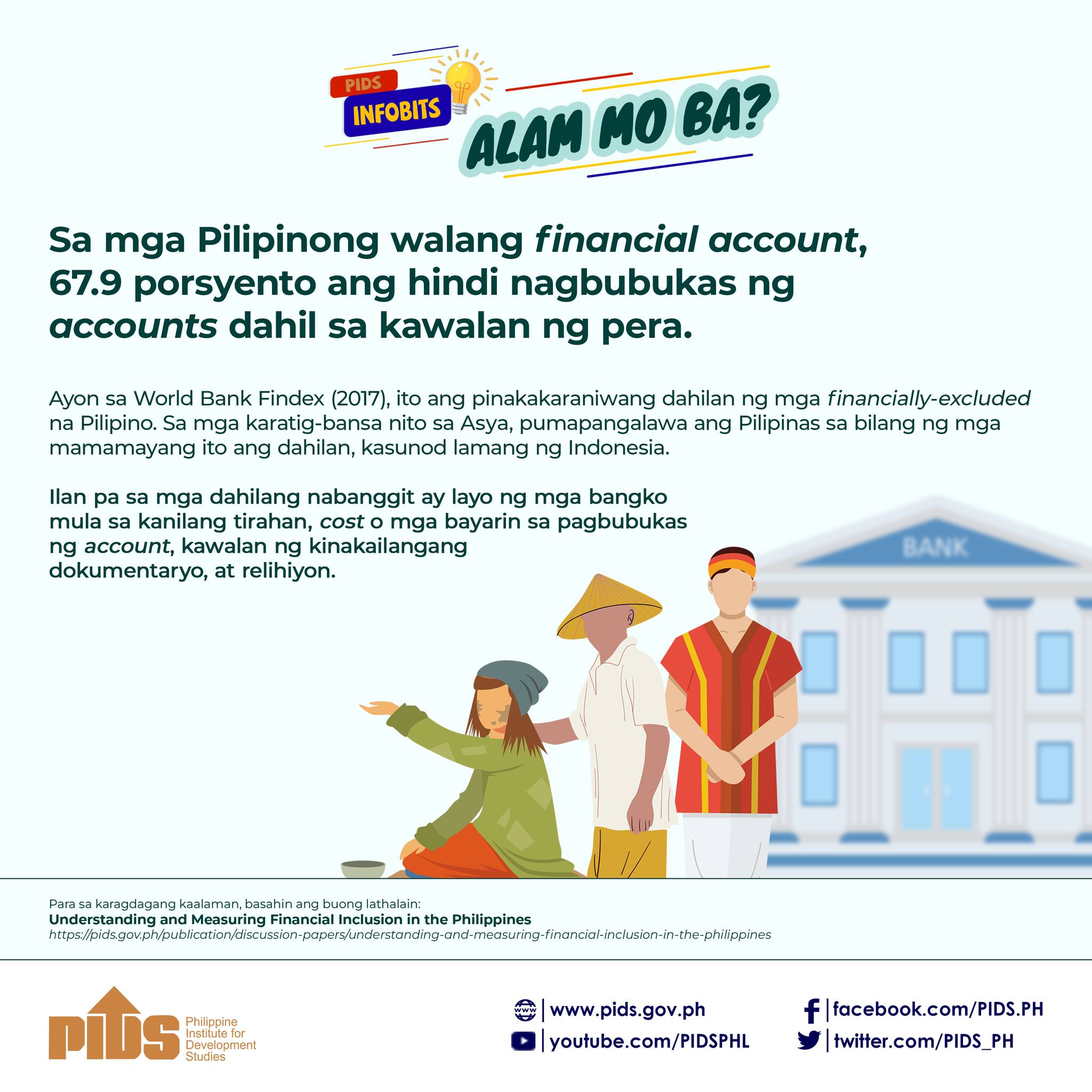

Limited access to financial assistance and options, however, has posed significant challenges for SMEs, hampering their ability to grow, innovate, and seize opportunities. SMEs’ financing hurdles are due to a lack of collateral, limited credit history, high interest rates, risk aversion, and even insufficient information infrastructure. The traditional financial system has frequently struggled to effectively leverage technology to address the unique requirements of SMEs, further exacerbating these setbacks.

Recognizing the pivotal role of finance in boosting competitiveness and enabling businesses to capitalize on economic opportunities, the government and private financial institutions are breaching the barriers and enhancing access to SME financing through innovative solutions.

Over the years, alternative financing options such as crowdfunding platforms have emerged to bridge the financing gap for SMEs. These platforms offer a unique way for businesses to access capital directly from a diverse pool of individual and institutional investors, leveraging technology and connectivity to create a transparent and efficient digital marketplace.

Investree Philippines, a joint venture between Filinvest Development Corporation through F(DEV) Digital Innovations and Ventures, Inc., and Investree Singapore Pte Ltd. and the country’s first recipient of a permanent crowdfunding license from the Securities and Exchange Commission (SEC), stands as a prime example of such a solution. Its platform empowers SMEs to showcase their potential and attract funding from investors who believe in their vision. In a significant development this year, the company has adopted an AI-based credit solution to revolutionize credit assessment for SMEs. This innovative solution represents a departure from traditional and stringent risk and credit assessments, which frequently fail to recognize the potential that SMEs bring to the Philippine economy. By embracing innovative approaches such as Investree Philippines’ AI-based credit assessment, SMEs can overcome the traditional barriers associated with conventional financing, democratize access to finance, and unlock their full potential, contributing significantly to the vibrancy and resilience of the Philippine economy.

Sustainably bridging the country’s financing gap

Understanding the unique challenges faced by SMEs, Investree Philippines has been a dedicated crowdfunding platform committed to empowering entrepreneurs through inclusive supply chain financing solutions since its launch in 2020, during the onset of the COVID-19 pandemic. Driven by its mission of fostering an ecosystem where SMEs can benefit from equal access to opportunities, the platform has served 135 SMEs across diverse industries as of June 2023, enabling these businesses to explore and expand new business horizons.

With the company’s vision to provide the SME community with a fair and transparent platform, Investree Philippines has funded more than 600 applications from its pool of SMEs, upholding its significance as a reliable and sustainable financing partner that caters to the specific needs of these growing enterprises.

“They provided us with a loan that helped us meet our requirements. It helps in our operations na hindi kami masyadong nahirapan [that we didn’t have much of a hard time] because there was some kind of bridge financing at the time that we needed it most. It’s very helpful and very timely. We’re happy, “shared Efren Chatto, owner of King Louis Flower and Plants.

Advancing financial sustainability means reducing the stigma associated with digital and platform-based alternative SME financing. Strengthening financial literacy is a way to encourage SMEs to explore other financing options, which is the objective of the SEC’s nationwide campaign series, Roadshows on Capital Formation for MSMEs and Startups, that brings together entrepreneurs, industry experts, and government representatives, in which Investree Philippines actively participates. Through this campaign, the platform works with the government to further improve crowdfunding regulations, bridge the knowledge gap, and raise awareness about the potential of the capital market to meet the financing needs of the SME community.

Exhibit participation programs such as PhilSME and company-initiated events and campaigns such as the Go & Grow Program that aim to provide efficient face-to-face consultations and application assistance to business owners are also being launched to personally connect and build meaningful relationships with more SMEs, enhance brand visibility, enable a deeper understanding of their needs, and help them navigate the unique financing process of the platform seamlessly.

Investree Philippines Country Manager Alexander Capulong emphasized, “We prioritize delivering exceptional service quality to our SME clients. Despite the predominantly digital nature of our platform, we aim to create a supportive and personalized experience. We strive to be a trusted partner that understands their needs, assists them in connecting with investors, and advocates for their financial sustainability. Through our dedicated approach, we aim to empower SMEs and foster their growth and success in the competitive business landscape.”

Through these events, the company also provides speaking engagements about the advantages of crowdfunding, which contributes to the overall financial literacy of SMEs, empowering them to make informed decisions and take advantage of available financing opportunities.

Breaking financing barriers by leveraging AI technology

The need for more efficient access to financing through technology has rapidly increased in the past year, and digitalization has paved the way for greater inclusion in the financial landscape. Building a more robust digital finance infrastructure is critical to boosting SME confidence, extending innovative solutions to previously underserved markets, and cultivating broader economic growth.

Recognizing the transformative nature of AI technology, Investree Philippines has taken innovative measures to promote a more financially inclusive and dynamic entrepreneurial ecosystem. The platform serves as a tool and support to provide SMEs with more accessible and inclusive alternative financing solutions to enable them to acquire additional capital to fulfill time-critical projects and expand their businesses.

“As a crowdfunding pioneer in the country, we embrace the evolving landscape of technology, AI, and other emerging solutions to redefine SME financing and bridge the gap between potential and success. Our commitment lies in empowering entrepreneurs with transformative finance solutions that offer new opportunities for growth. By taking advantage of innovation, we pave the way for financial inclusion, which provides businesses with tools and support to prosper, contributes to economic prosperity, and shapes a brighter future for our business community,” says Investree Director and F(DEV) CEO Xavier Marzan.

Using the power of AI and technology, Investree Philippines is committed to redefining how SMEs access financing. With its notable implementation of a sophisticated AI-powered credit assessment solution, the fintech crowdfunding platform has substantially improved the accuracy and inclusiveness of assessing SMEs, even in cases where credit histories are limited.

By leveraging the power of AI, the platform is able to conduct extensive evaluations of SME applicants, taking into consideration a variety of data points and factors beyond traditional credit metrics. This advanced credit assessment solution has opened doors for a broader range of SMEs, including those that conventional lenders may have neglected due to their lack of established credit history.

Building a community of equal growth opportunities

Efforts to bridge the SME financing gap in the country have made significant progress over the years, but there remains a collective responsibility to further improve and build a more robust and inclusive financing landscape in the Philippines. Industry stakeholders are committed to enhancing the availability and accessibility of financing options for SMEs. It is crucial to continue fostering an environment that supports the growth and success of Filipino businesses. By embracing technology, encouraging collaborations, and advocating supportive policies, a thriving ecosystem that enables SMEs to develop and contribute to economic growth can be achieved.

Take part in the journey toward breaking down barriers and empowering SMEs to realize their full potential. Whether it’s expanding operations, investing in new equipment, or initiating innovative projects, Investree Philippines is prepared to provide the capital and expertise necessary to fuel SME growth. Fully registered SMEs with at least a year of operations delivering goods and services to corporate clients across the country are encouraged to use the platform to explore new opportunities and unlock avenues for growth.