The Philippines Senate officially ratified the Regional Comprehensive Economic Partnership (RCEP) Agreement in February 2023, making the country the last signatory aside from Myanmar to conclude this free trade agreement.

The RCEP is the world’s largest free trade agreement, comprising of members Australia, Brunei, Cambodia, China, Indonesia, Japan, South Korea, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, Thailand, and Vietnam. The agreement also covers one-third of the world’s population, and its members contribute to 30 percent of global GDP.

The RCEP offers opportunities in trade and investment for the Philippines, especially in deepening economic integration among RCEP member states and bringing healthy competition to industries in the country. A study by the Philippine Institute for Development Studies estimated that the Philippines GDP would increase by two percent through the country’s participation in the RCEP.

Further, according to the Asian Development Bank (ADB), the RCEP could increase the Philippines’ export by 3.7 percent by 2030, an addition of US$7 billion. Also, a study conducted by the International Trade Center based in Geneva highlighted that the country has an estimated US$27.8 billion of unrealized export potential to RCEP countries over the next five years.

Philippine MSMEs and the global value chain

The RCEP provides an array of enhanced trade facilitations for participants that aim to make cross-border trade simpler and more efficient. Moreover, member states in the RCEP aim to cut or remove tariffs of goods traded among signatory parties meaning increased opportunities for micro, small, and medium-sized enterprises (MSMEs) in the Philippines to offer their services or products globally, as well as have greater participation in global value chains (GVC).

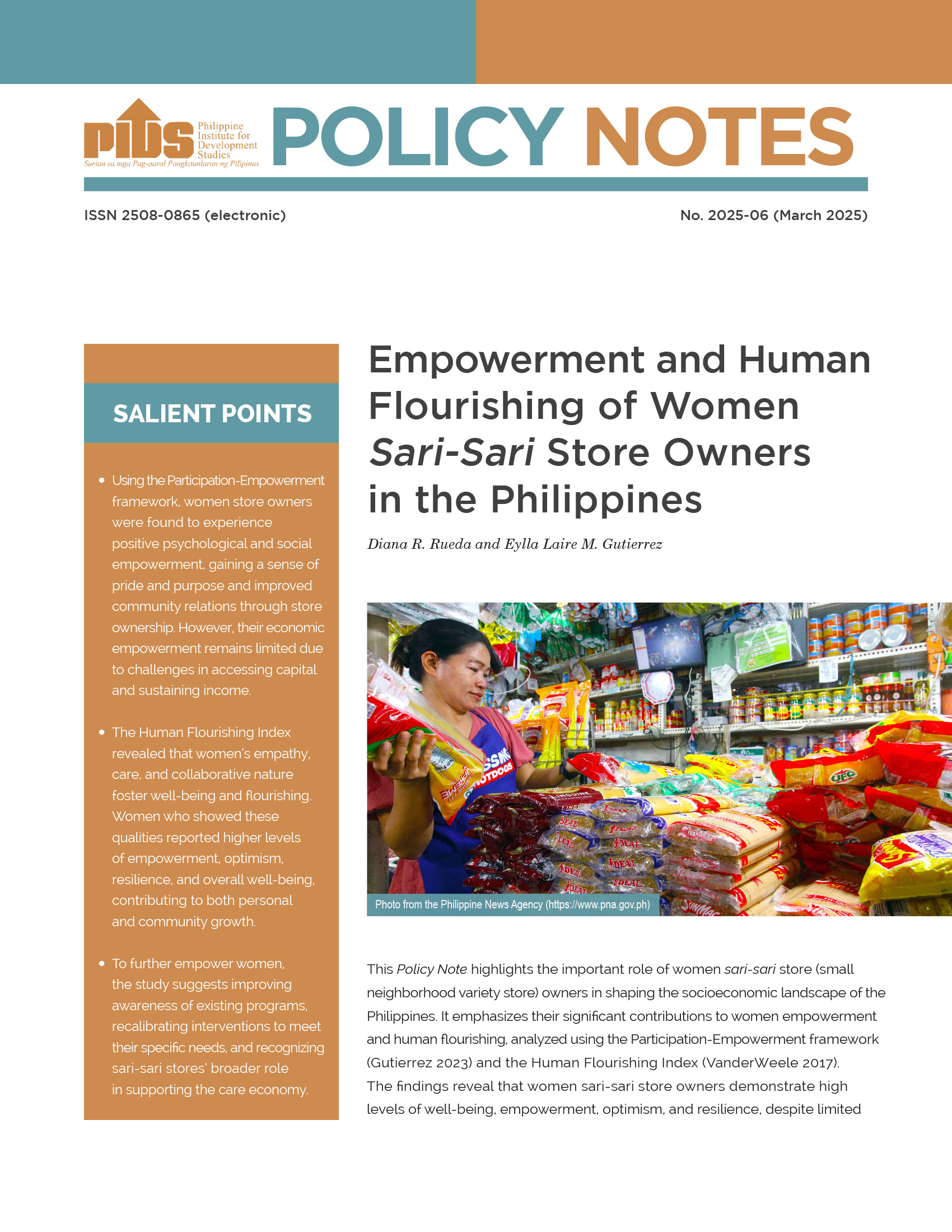

MSMEs are an important driver of the Philippine economy as they account for 99 percent of businesses in the Philippines and 60 percent of total employment. However, Philippine MSMEs are weakly linked to GVCs.

This has been attributed to increasing competition among other SMEs in Southeast Asia; the inability to uphold international standards and regulatory requirements; access to financing; unavailability of skilled labor; the inability to mass produce, and access to technology.

Access to financing remains one of the biggest constraints to MSMEs in the Philippines as many businesses operate in the informal sector. As a result, may do not pass the stringent documentary requirements needed to obtain formal bank loans.

Through the RCEP, businesses in the Philippines can benefit from a liberalized rule of origin. Coupled with greater technical cooperation with advanced industrialized nations such as China, Japan, South Korea, and Australia, Philippine businesses can develop better, more competitive products and services. Further, inclusion in GVCs would help them realize economies of scale.

Key Philippines sectors that can benefit from the RCEP

Agriculture

The RCEP did face opposition from agricultural groups in the Philippines, who fear an influx of imported produce into the country. However, Secretary of the National Economic and Development Authority — an independent cabinet-level agency responsible for economic development and planning — Arsenio Balisacan has shut down concerns that the RCEP will negatively impact the country’s agriculture sector.

Under the RCEP, only 15 agricultural commodity groups out of 33 tariff lines will have tariff reductions. Further, most of these commodity groups are for agricultural products not produced in the Philippines. The 33 agricultural tariff lines are equivalent to 1.9 percent of the more than 7,000 agricultural tariff lines and only make up 0.8 percent of imports.

The value of the country’s top 10 agricultural exports was valued at US$6.49 billion in 2022, or 95 percent of the total agricultural export revenue.

The sector also contributes to an estimated 10 percent of GDP. However, the sector has only grown around two percent per year in real terms, compared with the economy’s five percent growth. Further, the sector is plagued with low levels of mechanization and the country has one of the region’s oldest farmers with the average of 57.

Through the RCEP, the Philippines can encourage investments in AgriTech to drive up yields and improve irrigation, as well as in infrastructure to reduce export related costs and food wastage.

Electronics

The Philippines’ electronics sector is one of the biggest contributors to the country’s manufacturing output.

The export of electronics and semiconductors are expected to reach US$50 billion in exports for 2023, rising from US$45.92 billion in 2022. The export of semiconductors makes up 47 percent of the total goods exported from the Philippines, or the equivalent of US$29.2 billion.

The RCEP can help increase the export coverage for Philippine electronics and semiconductor manufacturers. Importantly, the RCEP will reduce the costs of imported components and raw materials as well as for the exported electronic goods. The sector is heavily reliant on imported parts and remains as the back-end assembly and testing stage of the supply chain. Moreover, the imported components are often re-exported to other markets such as China as intermediate products, further extending the economic distance from the final consumer.

Through greater market access, the Philippines is also aiming to attract investments that will move up the global value chain. There is a need to upgrade the industry’s GVC participation, especially in areas with high growth potential such as consumer electronics, power electronics, biomedical electronics, and auto electronics.

Business process outsourcing

The business process outsourcing (BPO) industry in the Philippines is one of the fastest growing and dynamic sectors of the economy, contributing some US$30 billion each to the economy each year or the equivalent of 11 percent of GDP.

The Philippines controls between 10-15 percent of the global BPO market and over 1.3 million Filipinos are employed in over 1,000 BPO companies. There are also an estimated 1.5 million Filipino freelance workers on various digital platforms.

Further, approximately 77 percent of the Philippines’ BPO export is for companies based in the US with the remainder shared in the Asia Pacific.

The RCEP can attract investments to expand the BPO industry into the next level of outsourcing, namely knowledge process outsourcing (KPO).

KPO services comprises of IT outsourcing, legal transcription, animation game development, and healthcare processing and coding, data analytics, financial research, and software development are just a few KPO employment opportunities that are attracting multinational companies.

Critical reforms must continue

To maximize any potential gains from the RCEP, the Philippines must continue crucial reforms that improve the competitiveness of local businesses.

When the country joined the ASEAN Free Trade Agreement in 1994 domestic reforms were slow and only incremental improvements in policies were made. This led to many businesses relocating to other ASEAN member states with more advantageous labor laws, better infrastructure, cheaper electricity, lower logistic costs, and better business incentives.

Major reforms did begin under the previous president Rodrigo Duterte such as amending the Philippine Foreign Investment Act to allow, for the first time, international investors to setup and fully own domestic enterprises, including micro and small enterprises.

Other laws that have been amended include the Trade Liberalization Act which reduces the minimum paid-up capital requirements for foreign retail enterprises as well as lowering the investment requirements for each store owned by a foreign enterprise. Further, the Public Service Act was amended to allow the 100 percent foreign ownership of public services in the Philippines.

Most recently, the government has allowed the 100 percent foreign ownership of renewable energy projects in the Philippines.