THE government intends to increase and improve social protection (SP) coverage in the country to include Overseas Filipino Workers (OFWs), seniors, and more poor households, according to the Philippine Development Plan (PDP).

This will be done by creating an integrated social protection system that seeks to establish a standard menu of programs that will address individual and lifecycle risks; economic risks; natura, climate-induced, and human-induced hazards; and governance and political risks.

Based on the PDP, the government intends to increase its total expenditures on social protection programs as a percentage of GDP to 3.13 percent this year; 3.55 percent next year; 3.98 percent in 2025; 4.49 percent, 2026; 4.83 percent, 2027; and 5.25 percent, 2028. The 2021 baseline is 2.7 percent.

“There is a need to continue addressing recurrent and new risks facing vulnerable sectors and poor households. Several marginalized and vulnerable sectors need greater access to a variety of SP programs,” the PDP stated. “While the Philippine SP system has programs that can address various risks, access to these programs is largely uneven.”

Based on the PDP, the government intends to increase to 100 percent the coverage of families with social insurance this year and maintain this level of coverage in the medium term.

The government also aims to increase social protection coverage of poor households with members 18 years old and below who are 4Ps beneficiaries. The 2019 baseline is 64.52 percent.

This year, the target is to increase coverage to 67.5 percent; it is 71 percent in 2024; 74.5 percent, 2025; 78 percent, 2026; 81.5 percent, 2027; and 85 percent, 2028.

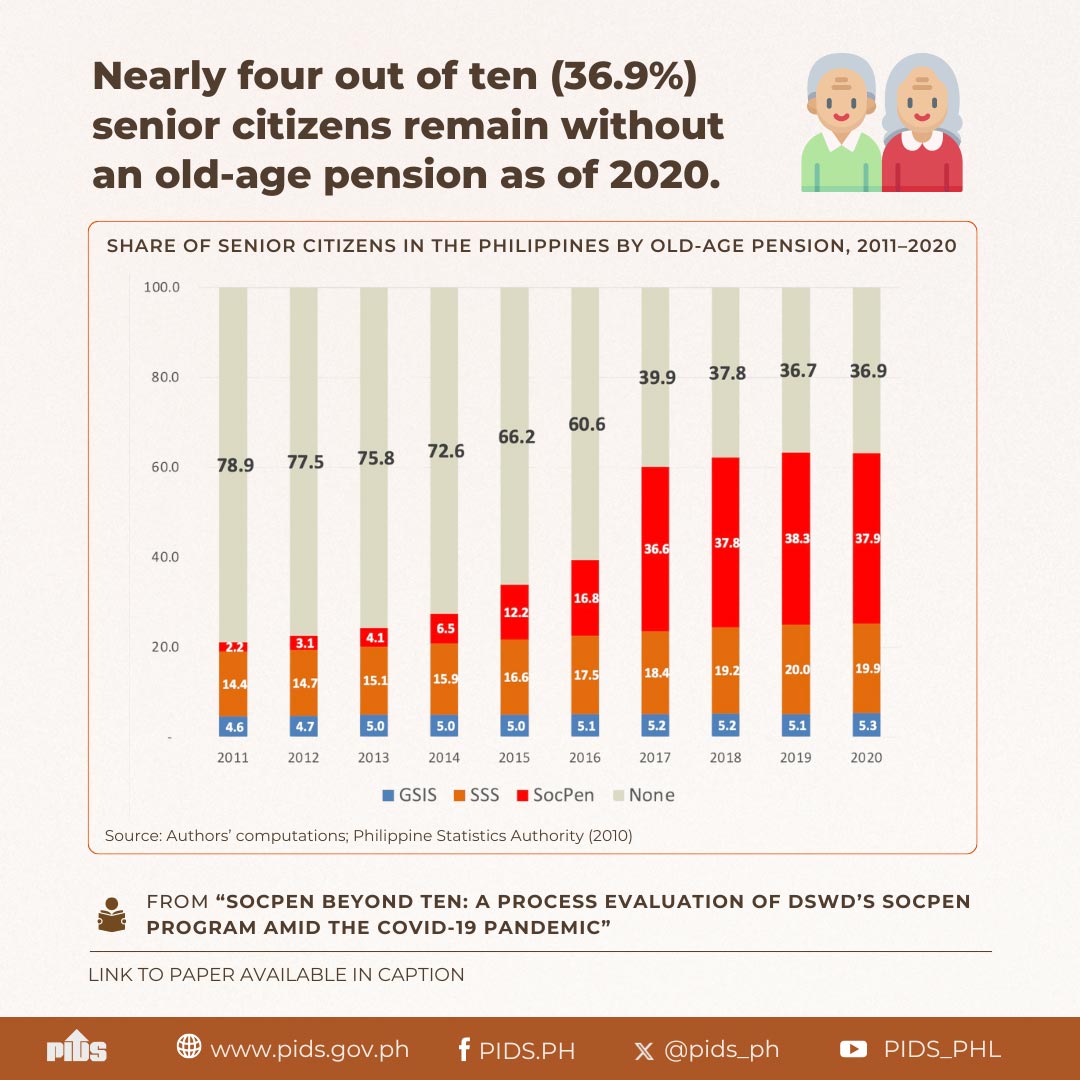

The targets also aim to increase the percentage of senior citizens receiving pension to 62.98 percent in 2023; 63.74 percent in 2024; 64.2 percent, 2025; 65.41 percent, 2026; 65.84 percent, 2027; and 66.53 percent, 2028. The 2021 baseline is 60.27 percent.

The government also plans to increase the percentage of documented Overseas Filipinos to total Overseas Filipinos covered by SP programs from the 88.9-percent baseline in 2021. However, no specific targets were set in the PDP between 2023 and 2028.

The Marcos administration also intends to increase the percentage of the economically active population contributing to the Social Security System (SSS) from the baseline of 37 percent in 2021.

The government intends to increase this coverage to between 39 and 40 percent this year; 40 to 41 percent in 2024 and 2025; 41 to 42 percent in 2026 and 2027; and 42 to 43 percent in 2028.

“The PDP 2023–2028 aims for the country’s economic transformation toward a prosperous, inclusive, and resilient society. To this end, implementing a rationalized and integrated social protection system will be a key strategy,” the PDP stated.

Based on the PDP, the poorest 40 percent of Filipinos received less from the government’s SP program compared to all households. It took a pandemic for the SP coverage of the poorest to exceed the transfers received by all households.

Data from the merged Labor Force Survey–Annual Poverty Indicator Survey (LFS–APIS) showed that households in the bottom 40 percent of the income distribution consistently registered lower SP coverage in 2017, 2019, and 2020 than for all households.

In 2017 and 2019, the SP coverage of the bottom 40 percent of households were at 57.29 percent and 61.79 percent, respectively. However, the coverage for all households was higher at 65.78 percent in 2017 and 72.85 percent in 2018.

In 2020, without the Social Amelioration Program (SAP) grants, some 66.09 percent of the bottom 40 percent of households were covered by SP programs. With the SAP, this coverage increased to 91.05 percent.

In the same year, SP coverage for all Philippine households was at 73.14 percent without the SAP and 90.69 percent with the SAP.

Meanwhile, in a recently published research, Senior Research Fellow Michael R.M. Abrigo of the Philippine Institute for Development Studies (PIDS), as well as Research Analysts Katha Ma-i Estopace, Zhandra C. Tam, and Kean Norbie F. Alicante, found that public transfers are good investments.

In a study spanning seven decades of government transfers, the researchers said the rates of return on these investments made by the government matched market interest rates.

Across generations, Generation Z or those born in the 2000s and 2010s, are expected to be the “clear winners” in terms of labor income relative to the government transfers they received.

“Each cohort expects to gain at least the equivalent of 2.4 percent of lifetime labor income, reaching upwards of 10 percent for generation Z cohorts, from the public transfer system,” the researchers said.

“Under our maintained modest growth assumption, the generation Z cohorts are the apparent overall winners of the public transfer system when net flows are normalized against expected lifetime labor income regardless of the discount factor we apply,” they added.

However, given the decline in birth rates, the researchers said the government must find other ways to finance these transfers. The researchers warned that there are “lifetime fiscal deficits in key programs, particularly social health insurance and old-age pension” which must be addressed.

“Identifying an optimal path that respects fiscal sustainability and generational fairness concerns in a dynamic social, economic and demographic environment should be an explicit government priority,” they added.