The country’s ageing population poses a challenge to the fiscal sustainability of the government’s Universal Health Care (UHC) program.

In his research paper, Financing Universal Health Care in an Ageing Philippines, Senior Research Fellow Michael Abrigo of state think tank Philippine Institute for Development Studies (PIDS) said that the growing elderly population in the Philippines will require more budget allocation for the UHC Act in the future.

The UHC Act is a landmark law that mandates the automatic enrolment of all Filipinos in the government’s National Health Insurance Program (NHIP) being managed by the Philippine Health Insurance Corporation (PHIC).

Based on the assumptions of the study, achieving a 100-percent enrollment in social health insurance (SHI) under the UHC program will require PHP 245- to PHP 251 billion (in 2015 prices) in government healthcare spending in 2020. Raising the share of health costs covered by SHI to 70 percent, on the other hand, will likely result in greater public spending at around PHP 391- to PHP 407-billion in the same year.

Abrigo explained that by 2050, the UHC Act fiscal requirements under these scenarios are projected to “increase to PHP 361- and PHP 604 billion, respectively, when longevity correction is applied”.

“These translate to about 1.3- to 1.4-percent annual increase in government healthcare spending to maintain the same level of services that the average Filipino received in 2015 for a growing and ageing population until 2050,” he explained.

Based on the 2015 data of the Philippine Statistics Authority, there are 7,548,769 senior citizens in the Philippines, or 7.5 percent of the total population. According to PSA’s projection, this will reach 11.4 percent in 2030 and 15.9 percent in 2045. Meanwhile, a 2017 report of the United Nations projected that the Philippines’ elderly population will grow to almost 15 million by 2050.

Abrigo also noted a huge increase in health spending among elderly people aged 65 years and above in 2015. The per capita health consumption grew from PHP 3,100 in 1995 to PHP 12,121 in 2015.

Such growth in health spending among senior citizens may be attributed to noncommunicable diseases, which may include major sicknesses such as cardiovascular illnesses, neoplasms, diabetes, hypertension, and kidney problems, as well as functional disabilities such as arthritis, rheumatism, and chronic back pain.

Moreover, a related PIDS study titled Silver Linings for the Elderly in the Philippines: Policies and Programs for Senior Citizens also highlighted the vulnerable situation of the elderly population.

According to the authors, PIDS President Celia Reyes, Research Specialist Arkin Arboneda, and Executive Assistant Ronina Asis, “senior citizens often suffer from several health conditions, take various maintenance medications, and/or require more interactions with healthcare providers.”

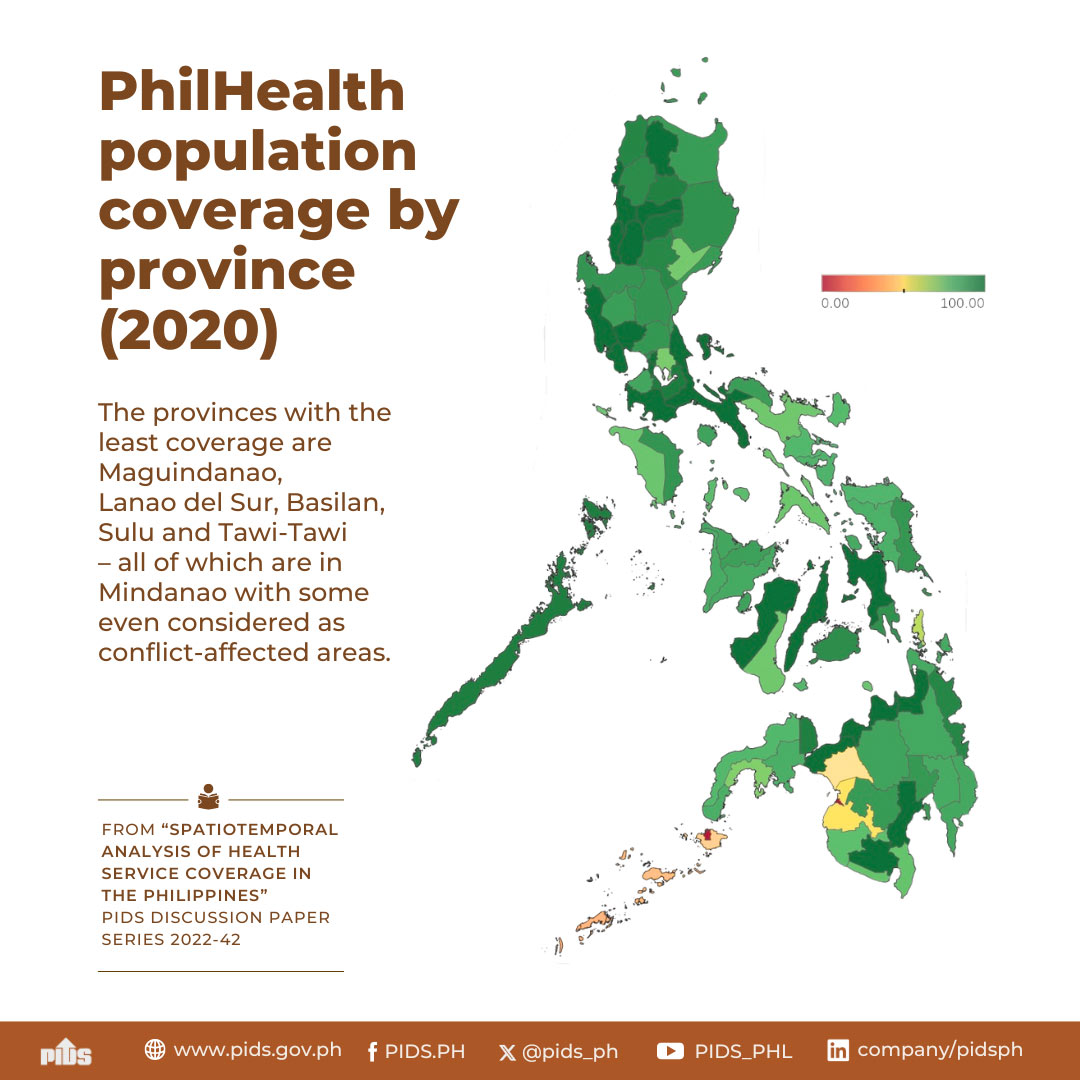

However, despite the universal coverage mandate of the UHC Act, the study noted that only 51.4 percent of the total elderly population is covered by PhilHealth as members and dependents.

Aside from PhilHealth, senior citizens are also covered by other social protection programs such as the Social Security System (SSS) or the Government Service Insurance System (GSIS). In 2017, their coverage to SSS or GSIS is only at 27.7 percent.

These figures imply that there is still a large percentage of senior citizens (32.1%) without access to any of these social protection programs.

“Across income deciles, the bottom 20 percent has the lowest share of elderly population with access to any of these programs, at only 56.0 percent and 56.6 percent of the elderly population in the bottom and second decile, respectively,” they said.

To ensure wider coverage of social protection programs for the elderly, especially among women and disadvantaged groups, the study urged the promotion of women’s employment in the labor force to improve their access to these programs when they reach the age of 60.

It also emphasized the need to re-examine the eligibility requirements of the social pension program to improve its targeting system. Further, the study urged the government to revisit the amount and frequency of payouts of the program.

Meanwhile, to sustain the country’s healthcare financing for its ageing population, Abrigo gave several recommendations.

One is to narrow the tax base to improve equity. However, he explained that this “may induce perverse health-seeking behaviors as a result of the weaker connection between (dis)incentives and individual actions that impinge on health”.

He also suggested putting huge investments on human capital to increase labor productivity and improve health outcomes. According to him, “this may contribute to expanding the tax base and lowering the aggregate health costs for [SHI] systems.”

Just like sin taxes, revenues from products that may adversely affect the health of the population such as sugary, salty, and fatty foods may also be used to finance the NHIP and other public health services.

The government may also introduce tax-exempt medical saving or investment accounts from which individuals may draw to finance future health expenditures on top of what is provided through the SHI system. This is being practiced in Singapore and the United States.

Cost-effective public health interventions such as health information, surveillance, and early detection of diseases should also be considered to lower future healthcare financing requirements. ###

In his research paper, Financing Universal Health Care in an Ageing Philippines, Senior Research Fellow Michael Abrigo of state think tank Philippine Institute for Development Studies (PIDS) said that the growing elderly population in the Philippines will require more budget allocation for the UHC Act in the future.

The UHC Act is a landmark law that mandates the automatic enrolment of all Filipinos in the government’s National Health Insurance Program (NHIP) being managed by the Philippine Health Insurance Corporation (PHIC).

Based on the assumptions of the study, achieving a 100-percent enrollment in social health insurance (SHI) under the UHC program will require PHP 245- to PHP 251 billion (in 2015 prices) in government healthcare spending in 2020. Raising the share of health costs covered by SHI to 70 percent, on the other hand, will likely result in greater public spending at around PHP 391- to PHP 407-billion in the same year.

Abrigo explained that by 2050, the UHC Act fiscal requirements under these scenarios are projected to “increase to PHP 361- and PHP 604 billion, respectively, when longevity correction is applied”.

“These translate to about 1.3- to 1.4-percent annual increase in government healthcare spending to maintain the same level of services that the average Filipino received in 2015 for a growing and ageing population until 2050,” he explained.

Based on the 2015 data of the Philippine Statistics Authority, there are 7,548,769 senior citizens in the Philippines, or 7.5 percent of the total population. According to PSA’s projection, this will reach 11.4 percent in 2030 and 15.9 percent in 2045. Meanwhile, a 2017 report of the United Nations projected that the Philippines’ elderly population will grow to almost 15 million by 2050.

Abrigo also noted a huge increase in health spending among elderly people aged 65 years and above in 2015. The per capita health consumption grew from PHP 3,100 in 1995 to PHP 12,121 in 2015.

Such growth in health spending among senior citizens may be attributed to noncommunicable diseases, which may include major sicknesses such as cardiovascular illnesses, neoplasms, diabetes, hypertension, and kidney problems, as well as functional disabilities such as arthritis, rheumatism, and chronic back pain.

Moreover, a related PIDS study titled Silver Linings for the Elderly in the Philippines: Policies and Programs for Senior Citizens also highlighted the vulnerable situation of the elderly population.

According to the authors, PIDS President Celia Reyes, Research Specialist Arkin Arboneda, and Executive Assistant Ronina Asis, “senior citizens often suffer from several health conditions, take various maintenance medications, and/or require more interactions with healthcare providers.”

However, despite the universal coverage mandate of the UHC Act, the study noted that only 51.4 percent of the total elderly population is covered by PhilHealth as members and dependents.

Aside from PhilHealth, senior citizens are also covered by other social protection programs such as the Social Security System (SSS) or the Government Service Insurance System (GSIS). In 2017, their coverage to SSS or GSIS is only at 27.7 percent.

These figures imply that there is still a large percentage of senior citizens (32.1%) without access to any of these social protection programs.

“Across income deciles, the bottom 20 percent has the lowest share of elderly population with access to any of these programs, at only 56.0 percent and 56.6 percent of the elderly population in the bottom and second decile, respectively,” they said.

To ensure wider coverage of social protection programs for the elderly, especially among women and disadvantaged groups, the study urged the promotion of women’s employment in the labor force to improve their access to these programs when they reach the age of 60.

It also emphasized the need to re-examine the eligibility requirements of the social pension program to improve its targeting system. Further, the study urged the government to revisit the amount and frequency of payouts of the program.

Meanwhile, to sustain the country’s healthcare financing for its ageing population, Abrigo gave several recommendations.

One is to narrow the tax base to improve equity. However, he explained that this “may induce perverse health-seeking behaviors as a result of the weaker connection between (dis)incentives and individual actions that impinge on health”.

He also suggested putting huge investments on human capital to increase labor productivity and improve health outcomes. According to him, “this may contribute to expanding the tax base and lowering the aggregate health costs for [SHI] systems.”

Just like sin taxes, revenues from products that may adversely affect the health of the population such as sugary, salty, and fatty foods may also be used to finance the NHIP and other public health services.

The government may also introduce tax-exempt medical saving or investment accounts from which individuals may draw to finance future health expenditures on top of what is provided through the SHI system. This is being practiced in Singapore and the United States.

Cost-effective public health interventions such as health information, surveillance, and early detection of diseases should also be considered to lower future healthcare financing requirements. ###