The “complex and multifaceted” nature of the digital economy creates tax issues, according to a study published by state think tank Philippine Institute for Development Studies (PIDS).

In her paper titled “Emerging Tax Issues in the Digital Economy”, former PIDS Research Fellow Janet Cuenca said the digital economy has changed the process of producing and marketing goods and services across borders. It significantly relies on “intangibles, the massive use of data, and the pervasive adoption of multi-sided business models”.

Cuenca underscored that the taxation of intangibles constitutes an immense challenge to policymakers as the current international tax framework is designed for “brick and mortar” businesses or “companies that have a physical presence or permanent establishment that is used to assign tax jurisdiction”.

New business models do not require physical presence; thus, companies can easily cut across borders to earn significant profits while having opportunities for tax avoidance.

An Asia-Pacific Economic Cooperation report identified some barriers and challenges confronting the Philippines in taxing the digital economy.

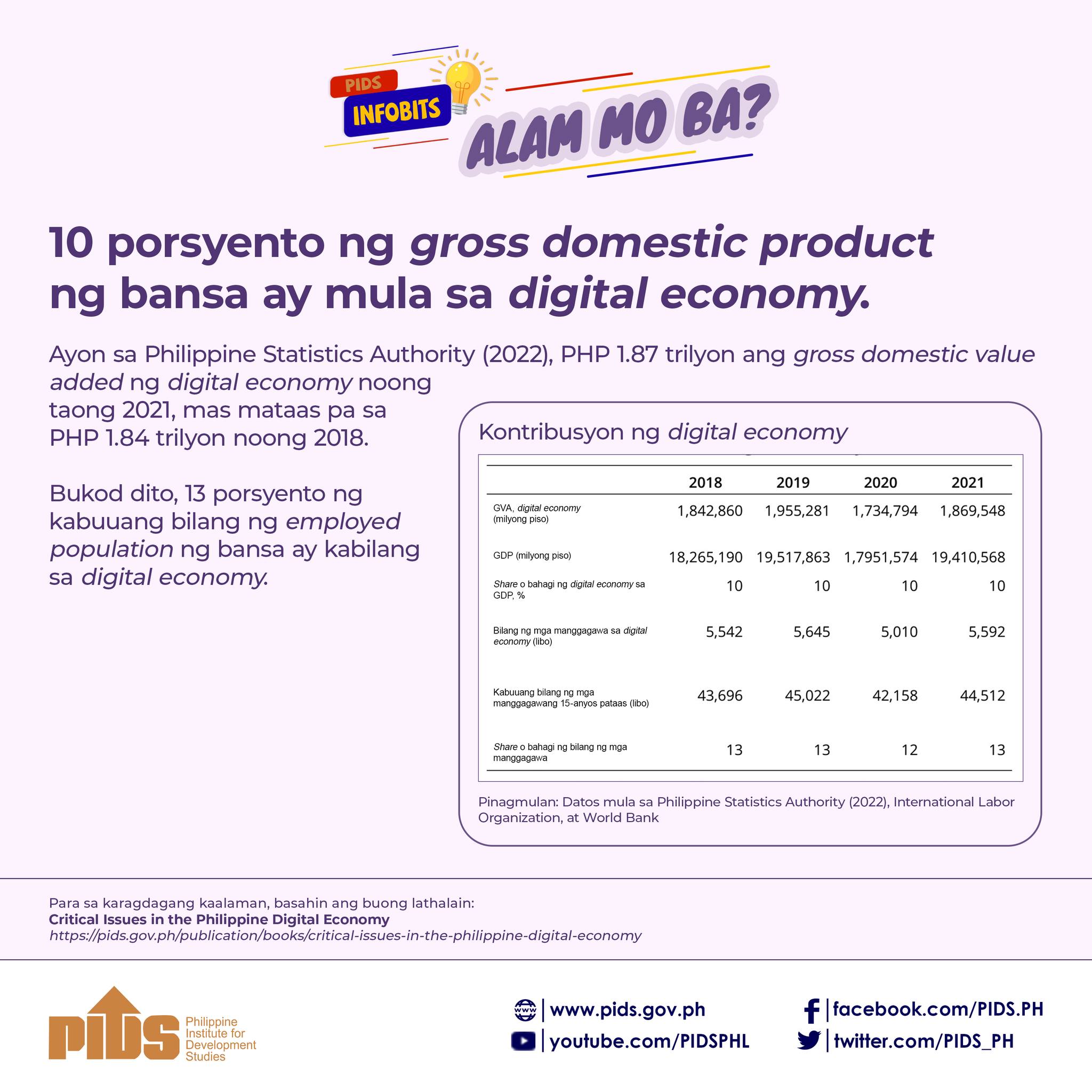

One issue is the scoping and measurement of the digital economy. The country lacks official industry data that measure the contribution of digital trade to the economy’s economic growth.

Although the Philippine Statistics Authority has started to measure the digital economy's contribution, the report revealed that there is still a lack of statistics that could explicitly measure the digital economy.

There is also no single standard definition of digital trade. Further, new business models “do not exactly fit” the traditional sectoral classifications.

Another barrier is the regulatory and legal framework that inhibits businesses “to explore and invest in more digital technology solutions”.

The study also pointed out some digital infrastructure challenges related to internet availability, affordability, quality, and reliance. For instance, the country ranks low in the Asia-Pacific region in terms of internet speed.

Significant policy gaps also hinder improvements in the digital economy. These include foreign ownership limitations that impede the entry of new players in the information and communications technology sector and the absence of a legal framework that will regulate business platforms and facilitate new digital products. Furthermore, the lack of a standard permit issued across local government units hampers infrastructure deployment. ###

In her paper titled “Emerging Tax Issues in the Digital Economy”, former PIDS Research Fellow Janet Cuenca said the digital economy has changed the process of producing and marketing goods and services across borders. It significantly relies on “intangibles, the massive use of data, and the pervasive adoption of multi-sided business models”.

Cuenca underscored that the taxation of intangibles constitutes an immense challenge to policymakers as the current international tax framework is designed for “brick and mortar” businesses or “companies that have a physical presence or permanent establishment that is used to assign tax jurisdiction”.

New business models do not require physical presence; thus, companies can easily cut across borders to earn significant profits while having opportunities for tax avoidance.

An Asia-Pacific Economic Cooperation report identified some barriers and challenges confronting the Philippines in taxing the digital economy.

One issue is the scoping and measurement of the digital economy. The country lacks official industry data that measure the contribution of digital trade to the economy’s economic growth.

Although the Philippine Statistics Authority has started to measure the digital economy's contribution, the report revealed that there is still a lack of statistics that could explicitly measure the digital economy.

There is also no single standard definition of digital trade. Further, new business models “do not exactly fit” the traditional sectoral classifications.

Another barrier is the regulatory and legal framework that inhibits businesses “to explore and invest in more digital technology solutions”.

The study also pointed out some digital infrastructure challenges related to internet availability, affordability, quality, and reliance. For instance, the country ranks low in the Asia-Pacific region in terms of internet speed.

Significant policy gaps also hinder improvements in the digital economy. These include foreign ownership limitations that impede the entry of new players in the information and communications technology sector and the absence of a legal framework that will regulate business platforms and facilitate new digital products. Furthermore, the lack of a standard permit issued across local government units hampers infrastructure deployment. ###