The government needs to reduce costs of agricultural lending and smallholder finance to make environment more conducive to increased private sector participation in smallholder finance, according to a paper released by state think tank Philippine Institute for Development Studies (PIDS).

The discussion paper, titled “Comprehensive Study on Credit Programs to Smallholders,” looks at the existing credit programs for smallholders, including agrarian reform beneficiaries (ARBs).

It also assesses the Agrarian Production Credit Program, a program being implemented in collaboration with the Department of Agriculture and the Land Bank of the Philippines for ARBs using agrarian reform beneficiary organizations as retailers.

The researchers noted that smallholder finance is considered more costly by banks because smallholders live in hard to reach areas with dispersed population and low literacy rates. Banks and formal financial institutions, on the other hand, are located in the towns and cities.

“Also, smallholders require relatively smaller amount of loans resulting in higher transaction cost per borrower. Because of these, extending loans to smallholders entail additional transaction costs for the banks,” they said.

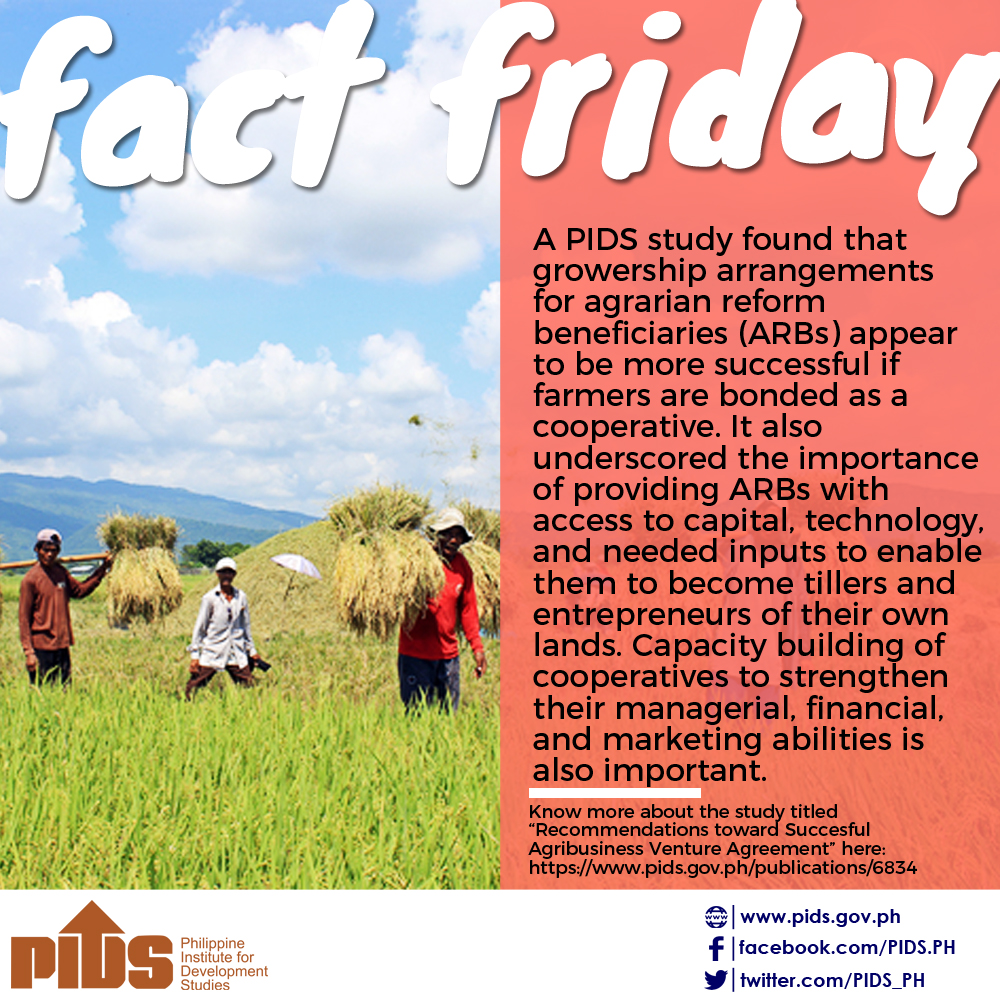

The researchers recommended that in the short-term, the government needs to strengthen and build capacities of smallholders’ and/or farmers’ organization as viable and sustainable conduits of financial services in rural areas, in particular cooperatives.

“Capacity building support should focus on enabling and strengthening these smallholder organizations (e.g. coops) to meet banks’ criteria for credit screening,” they said.

It can also allow banks to use innovative means of delivering financial services to the rural areas within a reasonable risk management framework.

The PIDS paper said promoting the use of mobile technology will also allow roaming agents to distribute finance and collect information from smallholders.

“The current framework of the BSP (Bangko Sentral ng Pilipinas) in the use of digital finance for reaching far-flung rural areas would help in reducing the banks’ transaction cost in lending to small farmers in these locations,” it said.

In the medium-term, the researchers underscored the need to build the required support infrastructure, such as farm-to-market roads that will reduce the costs of reaching the small farmers.

Moreover, they said the government should reduce risks associated with agricultural lending and smallholder finance arising from climate change and weather disturbances, seasonality of crop and production schedules and poor market linkages, and lack of adequate market information, among others.

PIDS urges gov’t to cut costs of agricultural lending, smallholder finance