To familiarize everyone with key socioeconomic terms and concepts, we are launching this new social media series.

For this week, our buzzword is “sin tax”.

It refers to a type of tax imposed on products considered harmful or socially undesirable, such as tobacco, alcohol, and sugary drinks. This is intended to discourage the consumption of these products while also generating revenue for the government.

Source: Investopedia (2023)

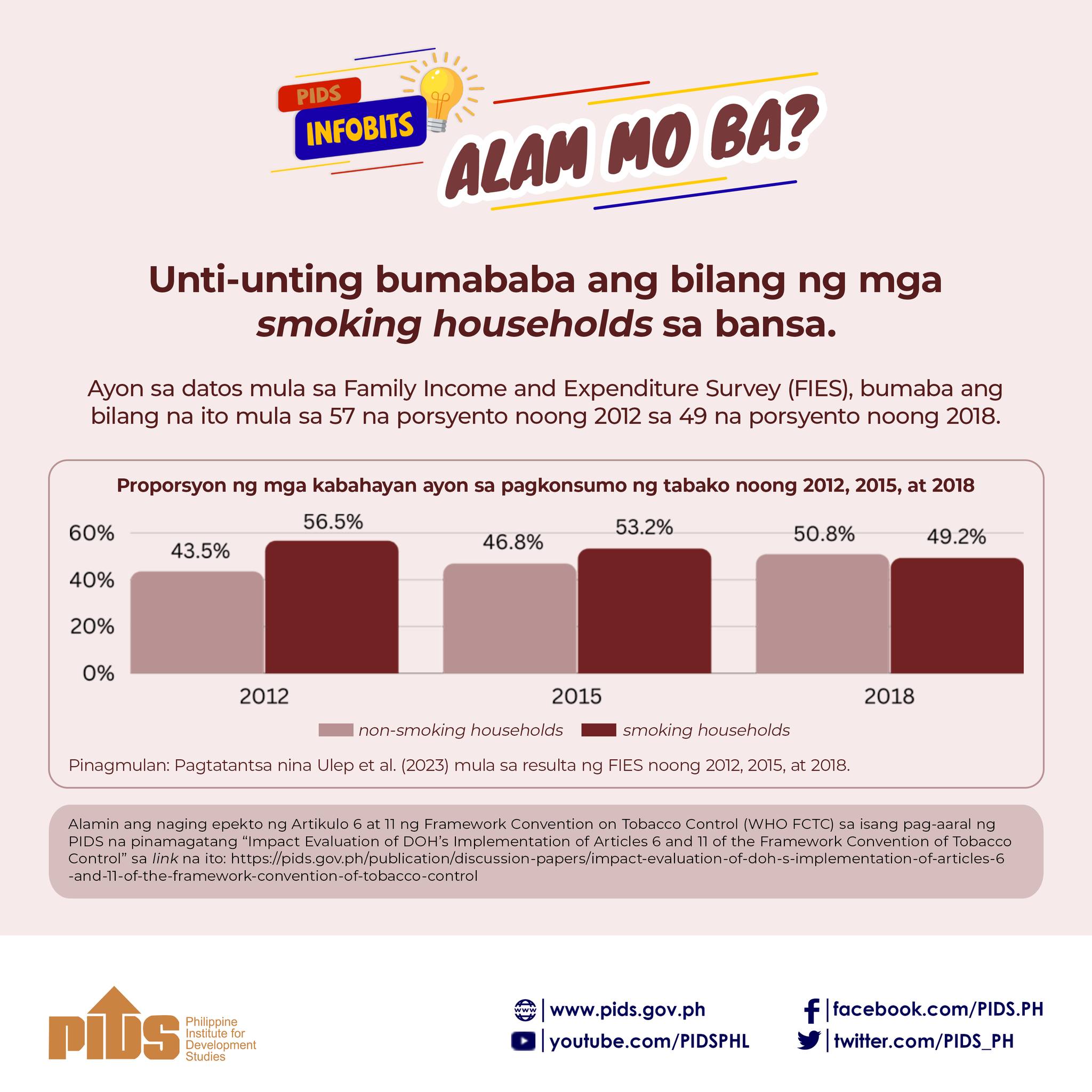

A PIDS study found that the implementation of the Sin Tax Law in the Philippines resulted in a significant decrease in smoking intensity (or the number of cigarettes purchased by smokers) and an increase in government revenue. The illicit trade of cigarettes was also observed to have increased between 2015 and 2018.

Know more about the state of tobacco control approaches in the Philippines by reading “Impact Evaluation of DOH’s Implementation of Articles 6 and 11 of the Framework Convention of Tobacco Control” available at https://www.pids.gov.ph/publication/discussion-papers/impact-evaluation-of-doh-s-implementation-of-articles-6-and-11-of-the-framework-convention-of-tobacco-control.

Gallery Images: