It is important to pass the new tax reform bill of the government as a package, according to a senior research fellow of the Philippine Institute for Development Studies (PIDS). This is not to say, however, that some of the components of the package should not be reviewed further.

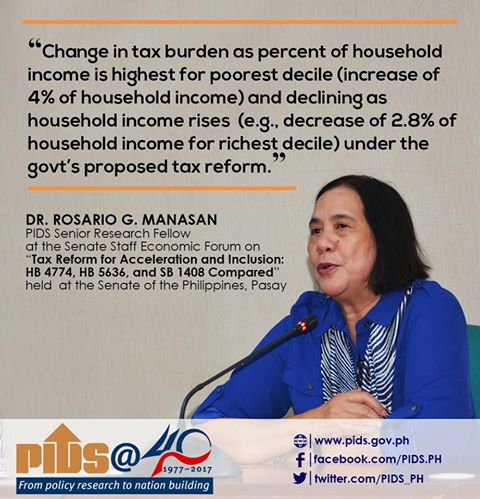

Dr. Rosario Manasan, an expert in public finance, explained that approving and implementing the TRAIN (Tax Reform for Acceleration and Inclusion) in a package increases the likelihood that it will bring in more revenues for the government.

The TRAIN bill is part of the Department of Finance’s (DOF) Comprehensive Tax Reform Program that recommends the lowering of personal income tax (PIT) but increasing excise taxes on fuel, new cars, and sugar products to offset possible losses.

The House of Representatives has already approved its version of the TRAIN (House Bill 5636) last June 2017. Currently, the Senate Committee on Ways and Means is deliberating on the HB 5636 as well as Senate Bill 1408, the version of the TRAIN that was filed by Senate President Koko Pimentel.

“I think the good thing about the proposed tax reform of the DOF is that it comes in as package. Dati nung 1977 may comprehensive tax reform program na tayo at totoong comprehensive yung mga studies na ginawa tungkol dito. Pero nung dinala na ito sa kongreso ay naging piecemeal ang pagpasa at dahil piecemeal, ang maraming nakapasa lang ay yung mga measures na may negative impact on revenue. Yung ibang mga measures na sana ay may positive impact on revenues ay hindi nakalusot kasi hindi popular,” Manasan pointed out.

[Translation: I think the good thing about the proposed tax reform of the DOF is that it comes in a package. Way back in 1977, we already had a comprehensive tax reform program and comprehensive studies were done about it. But when it was brought to Congress, it was passed in piecemeal which resulted to the passing of measures with negative impacts on revenues. The other measures which could have brought positive effects on revenues were not approved because they are not popular,” Manasan pointed out.]

Based on the proposed tax reform, the PIT of regular wage earners will be lowered from the current 32% to 25% which means that those earning below PHP 250,000.00 annually will be exempted from paying taxes.

Benefits

Manasan said that through the new tax reform, the government hopes to generate more revenues to finance its “build, build, build” program.

“I think the main goal of government in passing the new tax reform is to increase government revenues but the DOF wants to do it in a way that is fair, efficient, and easier to collect taxes,” she noted.

TRAIN, she said, will also fix “bracket creep” in PIT as well as resolve issues on overtaxing wage income earners.

“In terms of PIT, the proposed tax reform package will cure bracket creep in the present system. Ang tagal-tagal na kasi na hindi na-a-adjust nung mga income tax brackets. Noong 1997 isinabatas ang PIT na ginagamit natin ngayon, ipinapataw ang 30% na tax rate na-nag-aaply sa mga sumusweldo ng PHP 500,000. Sa ngayon ganun pa rin. 30% pa din ang tax sa mga kumikita ng PhP 500,000 per year kahit na mas konti na ang kayang bilhin ng PhP 500,000 sa panahong ito kumpara sa PhP 500,000 noong 1997. Also, compared to other countries, ang ating workers and households are more heavily taxed,” Manasan said

[Translation: In terms of PIT, the proposed tax reform package will cure bracket creep in the present system. The income tax brackets have been there for the longest time and have never been adjusted. It was in 1997 when the PIT, which we are using now, has been passed into law. It imposes 30% tax rate to those earning PhP 500,000. This still applies to this day. The 30% tax rate is still being imposed on those earning PhP 500,000 per year even if the value of PhP 500,000 today has decreased compared to the same amount in 1997. Also, compared to other countries, our workers and households are more heavily taxed,” Manasan said.]

Disadvantages

Admittedly, the proposed increase in excise tax on petroleum will have a domino effect on the prices of commodities and other services, Manasan stressed.

“Petroleum is an input in almost everything. In case of a fuel hike, there will be an increase in the cost of fares, electricity, and other products down the line,” Manasan said, adding that “both rich and poor will get affected” albeit, in different degrees.

In the case of the middle class and the rich, the higher taxes on the goods and services they consume due to the proposed increase in the excise tax on petroleum products and the expansion in the coverage of the value added tax under the TRAIN, will be mitigated by the reduction in the PIT, explained Manasan.

In contrast, poor families will not benefit from the reduction of the PIT because they are not paying any personal income tax even under the present system as their incomes are below the taxable threshold. But they are also bound to be adversely affected due to the proposed increase in the excise tax on petroleum products and expansion of the coverage of the VAT, she added.

However, a good feature of the DOF’s tax reform proposal, according to Manasan, is the highly targeted cash transfers that will be distributed to the poorest 40%-50% of all families in the country to address the abovementioned problem.

“Specifically, 40% of the increment on excise tax from petroleum will be used for targeted cash transfers. Target beneficiaries will be identified utilizing the National Household Targeting System of the DSWD, the same tool used by the Pantawid Pamilyang Pilipino Program (4Ps). But, both Congress and Senate have yet to decide whether to provide the targeted unconditional cash transfer for three years (per Senate Bill 1408) or one year only (House Bill 5636). My own recommendation is three years to give time for the transfer to have some impact on growth and benefit the poor,” Manasan underscored.

To know more about this study, please visit this link: https://pidswebs.pids.gov.ph/CDN/EVENTS/assessment_train_sb1408_rgm_25july2017.pdf.

Dr. Rosario Manasan, an expert in public finance, explained that approving and implementing the TRAIN (Tax Reform for Acceleration and Inclusion) in a package increases the likelihood that it will bring in more revenues for the government.

The TRAIN bill is part of the Department of Finance’s (DOF) Comprehensive Tax Reform Program that recommends the lowering of personal income tax (PIT) but increasing excise taxes on fuel, new cars, and sugar products to offset possible losses.

The House of Representatives has already approved its version of the TRAIN (House Bill 5636) last June 2017. Currently, the Senate Committee on Ways and Means is deliberating on the HB 5636 as well as Senate Bill 1408, the version of the TRAIN that was filed by Senate President Koko Pimentel.

“I think the good thing about the proposed tax reform of the DOF is that it comes in as package. Dati nung 1977 may comprehensive tax reform program na tayo at totoong comprehensive yung mga studies na ginawa tungkol dito. Pero nung dinala na ito sa kongreso ay naging piecemeal ang pagpasa at dahil piecemeal, ang maraming nakapasa lang ay yung mga measures na may negative impact on revenue. Yung ibang mga measures na sana ay may positive impact on revenues ay hindi nakalusot kasi hindi popular,” Manasan pointed out.

[Translation: I think the good thing about the proposed tax reform of the DOF is that it comes in a package. Way back in 1977, we already had a comprehensive tax reform program and comprehensive studies were done about it. But when it was brought to Congress, it was passed in piecemeal which resulted to the passing of measures with negative impacts on revenues. The other measures which could have brought positive effects on revenues were not approved because they are not popular,” Manasan pointed out.]

Based on the proposed tax reform, the PIT of regular wage earners will be lowered from the current 32% to 25% which means that those earning below PHP 250,000.00 annually will be exempted from paying taxes.

Benefits

Manasan said that through the new tax reform, the government hopes to generate more revenues to finance its “build, build, build” program.

“I think the main goal of government in passing the new tax reform is to increase government revenues but the DOF wants to do it in a way that is fair, efficient, and easier to collect taxes,” she noted.

TRAIN, she said, will also fix “bracket creep” in PIT as well as resolve issues on overtaxing wage income earners.

“In terms of PIT, the proposed tax reform package will cure bracket creep in the present system. Ang tagal-tagal na kasi na hindi na-a-adjust nung mga income tax brackets. Noong 1997 isinabatas ang PIT na ginagamit natin ngayon, ipinapataw ang 30% na tax rate na-nag-aaply sa mga sumusweldo ng PHP 500,000. Sa ngayon ganun pa rin. 30% pa din ang tax sa mga kumikita ng PhP 500,000 per year kahit na mas konti na ang kayang bilhin ng PhP 500,000 sa panahong ito kumpara sa PhP 500,000 noong 1997. Also, compared to other countries, ang ating workers and households are more heavily taxed,” Manasan said

[Translation: In terms of PIT, the proposed tax reform package will cure bracket creep in the present system. The income tax brackets have been there for the longest time and have never been adjusted. It was in 1997 when the PIT, which we are using now, has been passed into law. It imposes 30% tax rate to those earning PhP 500,000. This still applies to this day. The 30% tax rate is still being imposed on those earning PhP 500,000 per year even if the value of PhP 500,000 today has decreased compared to the same amount in 1997. Also, compared to other countries, our workers and households are more heavily taxed,” Manasan said.]

Disadvantages

Admittedly, the proposed increase in excise tax on petroleum will have a domino effect on the prices of commodities and other services, Manasan stressed.

“Petroleum is an input in almost everything. In case of a fuel hike, there will be an increase in the cost of fares, electricity, and other products down the line,” Manasan said, adding that “both rich and poor will get affected” albeit, in different degrees.

In the case of the middle class and the rich, the higher taxes on the goods and services they consume due to the proposed increase in the excise tax on petroleum products and the expansion in the coverage of the value added tax under the TRAIN, will be mitigated by the reduction in the PIT, explained Manasan.

In contrast, poor families will not benefit from the reduction of the PIT because they are not paying any personal income tax even under the present system as their incomes are below the taxable threshold. But they are also bound to be adversely affected due to the proposed increase in the excise tax on petroleum products and expansion of the coverage of the VAT, she added.

However, a good feature of the DOF’s tax reform proposal, according to Manasan, is the highly targeted cash transfers that will be distributed to the poorest 40%-50% of all families in the country to address the abovementioned problem.

“Specifically, 40% of the increment on excise tax from petroleum will be used for targeted cash transfers. Target beneficiaries will be identified utilizing the National Household Targeting System of the DSWD, the same tool used by the Pantawid Pamilyang Pilipino Program (4Ps). But, both Congress and Senate have yet to decide whether to provide the targeted unconditional cash transfer for three years (per Senate Bill 1408) or one year only (House Bill 5636). My own recommendation is three years to give time for the transfer to have some impact on growth and benefit the poor,” Manasan underscored.

To know more about this study, please visit this link: https://pidswebs.pids.gov.ph/CDN/EVENTS/assessment_train_sb1408_rgm_25july2017.pdf.