The implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) law could affect Filipinos living in poverty. However, its impact on poor households could be minimized through the proper implementation of the unconditional cash transfer (UCT) as stipulated in the law.

Under the TRAIN law, households belonging to the lowest five income deciles, which is estimated at 10 million poor families, are to receive cash assistance of PHP 200 per month in 2018, and PHP 300 per month in 2019 and 2020. Of the 10 million households, about 4.4 million are existing Pantawid Pamilyang Pilipino Program (4Ps) beneficiaries.

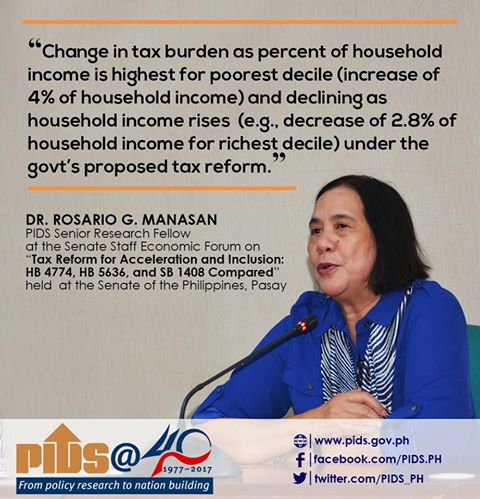

Using computable general equilibrium (CGE) analysis, Ateneo de Manila Assistant Professor Philip Tuaño estimated that poverty among households, in general, could increase by 1.72 percent due to changes brought by the TRAIN law. Fisherfolk and farmers are among the sectors that are expected to see the highest increase at 3.2 percent and 2.3 percent, respectively.

The first package of the TRAIN law covers the lowering of personal income taxes, simplifying the estate and donor’s taxes, expanding the value-added tax (VAT) base, adjusting oil and automobile excise taxes, and introducing excise tax on sugar-sweetened beverages.

However, Tuaño’s study showed that poverty incidence among households is likely to increase by only 0.26 percent if UCT is factored in. In this case, the increase in poverty incidence among fisherfolk and farmers is estimated at 1.35 percent and 0.06 percent, respectively. The poverty incidence among transport workers, on the other hand, is likely to rise by about 2 percent because of the TRAIN. But, with the implementation of the government’s Pantawid Pasadaprogram, a decline of 8 percent in poverty incidence is expected among transport workers.

Given that UCT can offset increases in poverty incidence across all sectors, Tuaño emphasized the importance of implementing the UCT in full.

Tuaño also pointed out that although the UCT can partially reverse the negative impact of TRAIN law on households, additional assistance from the government may still be needed to totally reverse the negative impacts of the law. The government, he added, should ensure that the revenues generated from the TRAIN law are allocated on programs aimed at alleviating the plight of poor and vulnerable households. Likewise, he urged the government to help families belonging to the seven lowest income deciles and not just those who are below the poverty line.

The full study may be downloaded here.

Under the TRAIN law, households belonging to the lowest five income deciles, which is estimated at 10 million poor families, are to receive cash assistance of PHP 200 per month in 2018, and PHP 300 per month in 2019 and 2020. Of the 10 million households, about 4.4 million are existing Pantawid Pamilyang Pilipino Program (4Ps) beneficiaries.

Using computable general equilibrium (CGE) analysis, Ateneo de Manila Assistant Professor Philip Tuaño estimated that poverty among households, in general, could increase by 1.72 percent due to changes brought by the TRAIN law. Fisherfolk and farmers are among the sectors that are expected to see the highest increase at 3.2 percent and 2.3 percent, respectively.

The first package of the TRAIN law covers the lowering of personal income taxes, simplifying the estate and donor’s taxes, expanding the value-added tax (VAT) base, adjusting oil and automobile excise taxes, and introducing excise tax on sugar-sweetened beverages.

However, Tuaño’s study showed that poverty incidence among households is likely to increase by only 0.26 percent if UCT is factored in. In this case, the increase in poverty incidence among fisherfolk and farmers is estimated at 1.35 percent and 0.06 percent, respectively. The poverty incidence among transport workers, on the other hand, is likely to rise by about 2 percent because of the TRAIN. But, with the implementation of the government’s Pantawid Pasadaprogram, a decline of 8 percent in poverty incidence is expected among transport workers.

Given that UCT can offset increases in poverty incidence across all sectors, Tuaño emphasized the importance of implementing the UCT in full.

Tuaño also pointed out that although the UCT can partially reverse the negative impact of TRAIN law on households, additional assistance from the government may still be needed to totally reverse the negative impacts of the law. The government, he added, should ensure that the revenues generated from the TRAIN law are allocated on programs aimed at alleviating the plight of poor and vulnerable households. Likewise, he urged the government to help families belonging to the seven lowest income deciles and not just those who are below the poverty line.

The full study may be downloaded here.