AFTER more than two decades, the domestic shipping industry has grown more competitive, but it remains saddled with inefficiencies, bringing consequences such as high cost of shipping, low quality of services, and high frequency of maritime accidents, according to new research.

The study published by the Philippine Institute for Development Studies (PIDS) found that government policy reforms from the 1990s to the present times have improved the industry’s performance somewhat, but that significant potential for modernizing and enhancing the competitiveness of the sector remains untapped.

This is unfortunate as the domestic shipping industry has a crucial role in the Philippine economy, serving as the backbone supporting domestic trade and providing an affordable means of inter-island transfer, said the paper.

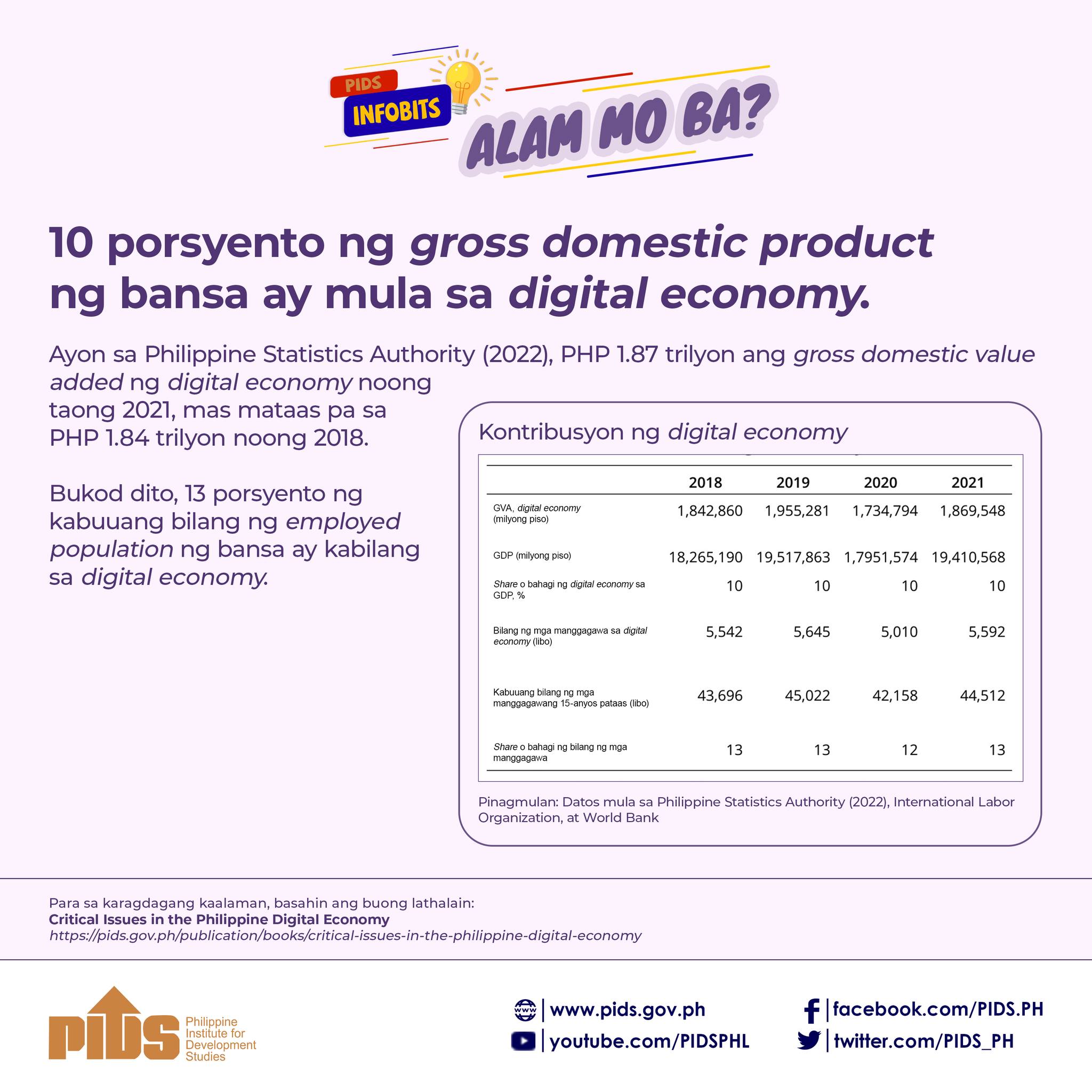

The Philippine Statistics Authority said in a 2019 report that 99.9 percent of domestic trade, equivalent to 25.89 million tons of goods, was transported via water that year.

The economy of an archipelagic country such as the Philippines depends highly on industries that facilitate physical connectivity.

“Against this backdrop, however, is an industry riddled with inefficiencies that lead to other issues such as high cost of shipping, ageing vessels, poor quality passenger and cargo shipping services, as well as frequent maritime accidents. Unfortunately, the main consequence of a poor-performing domestic shipping industry is slower economic growth and regional integration,” said the PIDS paper.

The report reviewed and assessed improvements in three areas of domestic shipping: market competition, investments, and maritime safety. It noted that overall, there have been some positive developments in market competition as a result of the government’s efforts to deregulate the industry.

There were also some indications of increased investments in domestic vessels, although the country’s shipping fleet remains older and smaller, on average, than those in other Asian countries.

This signifies the need for more intensive strategies to induce modernization of the country’s fleet, said study author Kris Francisco.

Maritime safety, on the other hand, leaves much to be desired despite government efforts to curtail the frequency of maritime accidents, she added.

The discussion paper released in August 2023 observed an oligopolistic domestic shipping market structure, where only a few firms are dominating scheduled operations. It pointed to a 2014 World Bank report that reviewed the sector and described it as having high cost, low quality of service, and high incidence of maritime accidents.

Poor state

The World Bank further postulated that the poor state of the Philippine domestic shipping industry was partly due to constraints to competition that limit opportunities and incentives for new and incumbent players in the market.

“Domestic shipping in the Philippines was found to be more expensive than other two archipelagic countries, Malaysia, and Indonesia. As reflected in the report, logistics costs in the country account for 24–53 percent of the wholesale price. Businesses also cited delays in shipment and slow cargo handling as common problems encountered,” the PIDS paper said.

Several underlying reasons have been identified for domestic shipping’s inefficiency. Aside from the oligopolistic market structure, the other factors are the low profitability despite improvements in the level of competition, the lack of investment in ships, and the absence of market scale.

Other exacerbating problems include a lack of connectivity, network planning and consolidation; scarcity of port and road infrastructure; and the conflicting roles of the Philippine Ports Authority.

But the report said improving competition is not necessarily about having more competitors on individual routes, but about “making sure that barriers to competition are removed or minimized, to induce greater efficiency in the industry that would hopefully translate to better quality of ships, services, increased capacity, as well as lower shipping rates and maritime accidents.”

In terms of investment, research showed that “policies on encouraging investments in the domestic shipping industry appear to be relatively meager when compared with policies on market liberalization and maritime safety.”

Despite government reforms and incentives, investment in domestic shipping vessels can still benefit from further encouragement.

“Efforts on encouraging investments in the domestic shipping industry should still be intensified as our vessels remain relatively older and smaller than that of other Asian countries. These characteristics of shipping vessels not only have disadvantages in terms of trade but also have complementary safety implications,” Francisco said.

On the other hand, in terms of maritime safety, significant changes in the number of maritime accidents in the country have yet to be observed as annual maritime accidents even increased between 2001 and 2014 despite government efforts to reduce the numbers, the research revealed.