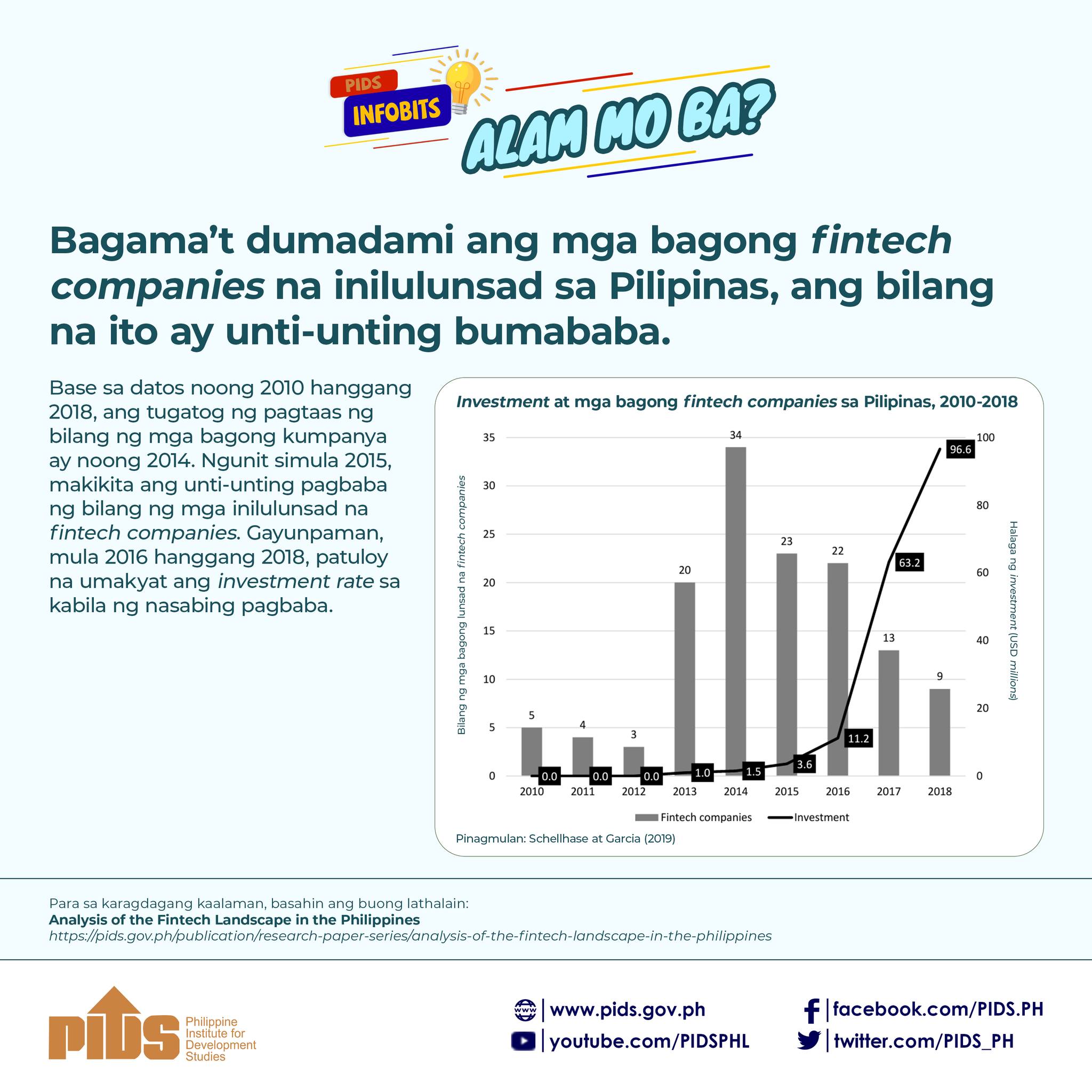

Financial technology (fintech) in the Philippines has gained more attention in recent years, especially during the onset of the COVID-19 pandemic when lockdowns were prevalent and cashless payments were encouraged. Thus, digital payments and engagements through various platforms have increased, resulting in more diversified financial products and services. Despite these developments, financial inclusion in the Philippines has lagged behind other Association of Southeast Asian Nations member-states. This paper analyzes the state of the fintech industry and investigates how the government can support the development of its ecosystem to ensure its contribution to the country’s development goals. It concludes that the Philippines has a strong fintech industry, as indicated by a growing number of fintechs (particularly in payments, lending, and banking technology verticals) and increasing capitalization. Finally, for the fintech industry to support the country’s financial inclusion goals, the availability of talent and credit for the sector must be improved.

Citations

This publication has been cited 3 times

- Gamboa, J. Albert. 2023. Outpacing financial regulations. BusinessWorld.

- Jocson, Luisa Maria Jacinta. 2023. Poor literacy, infrastructure may hamper fintech sector’s growth. BusinessWorld.

- Victoria Hollingshead . 2025. Digitizing Inclusion: FinTech’s Promise and Pitfalls in the Global South. Medium.